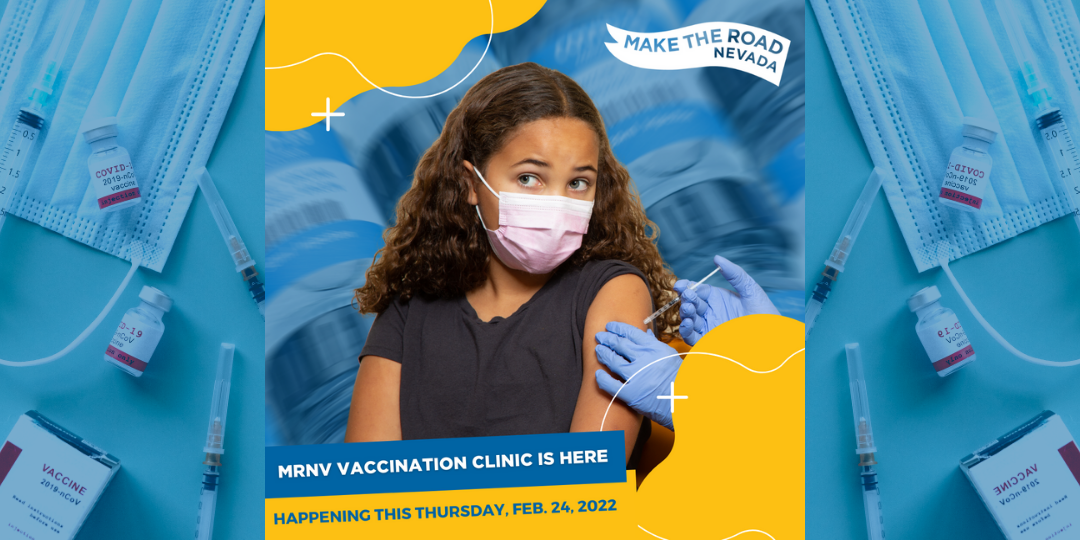

22 Feb Make the Road Nevada’s Free Vaccination Clinic is Here!

Make the Road Nevada and Touro University are teaming up for a free vaccine clinic event this Thursday, February 24th, from 3:00 pm to 6:00 pm inside our office. All three COVID-19 vaccinations will be available fo adults and children 12+. The flu shot will...